Loan Service Providers: Helping You Recognize Your Economic Aspirations

Wiki Article

Discover Reliable Finance Services for All Your Financial Requirements

In navigating the substantial landscape of financial solutions, discovering dependable financing carriers that cater to your certain requirements can be a challenging job. Let's explore some vital factors to think about when looking for out car loan solutions that are not only trustworthy but likewise customized to meet your special financial demands.Sorts Of Individual Loans

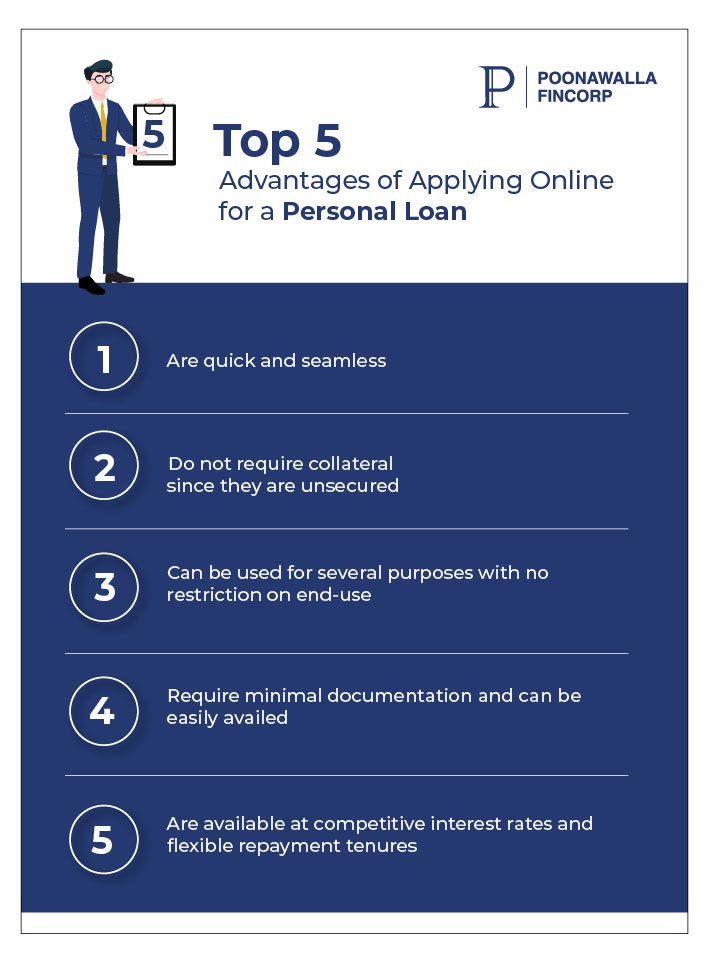

When thinking about personal financings, individuals can select from different kinds customized to meet their particular economic requirements. One usual kind is the unsafe individual financing, which does not need security and is based upon the borrower's creditworthiness. These financings generally have greater passion rates because of the raised risk for the loan provider. On the various other hand, protected personal car loans are backed by collateral, such as a vehicle or interest-bearing accounts, causing reduced rates of interest as the lending institution has a type of protection. For individuals looking to settle high-interest financial debts, a financial obligation consolidation loan is a sensible choice. This kind of financing incorporates multiple financial debts right into a solitary month-to-month repayment, frequently with a reduced rate of interest. Furthermore, people looking for funds for home remodellings or significant purchases might go with a home enhancement car loan. These loans are particularly designed to cover costs associated with enhancing one's home and can be secured or unprotected relying on the loan provider's terms.Benefits of Online Lenders

Comprehending Credit History Union Options

Discovering the diverse range of cooperative credit union alternatives can give individuals with a valuable choice when looking for monetary solutions. Credit unions are not-for-profit financial cooperatives that supply a series of items and solutions comparable to those of banks, including financial savings and checking accounts, lendings, credit history cards, and much more. One essential difference is that credit rating unions are possessed and run by their members, that are also consumers of the establishment. This ownership framework usually equates into lower costs, competitive passion rates on fundings and interest-bearing accounts, and a strong emphasis on customer support.Cooperative credit union can be appealing to individuals seeking an extra tailored approach to banking, as they generally prioritize member complete satisfaction over revenues. Furthermore, credit report unions often have a solid area visibility and might use economic education and learning sources to assist participants improve their financial literacy. By recognizing the options offered at debt unions, people can make enlightened decisions regarding where to entrust their monetary requirements.

Checking Out Peer-to-Peer Financing

One of the key tourist attractions of peer-to-peer lending is the possibility for reduced interest rates contrasted to conventional economic organizations, making it an enticing option for debtors. Additionally, the application procedure for obtaining a peer-to-peer finance is usually structured and can result in faster access to funds.Capitalists also take advantage of peer-to-peer financing by possibly earning higher returns contrasted to conventional investment choices. By reducing out the middleman, capitalists can directly fund consumers and receive a part of the passion payments. It's crucial to keep in mind that like any investment, peer-to-peer financing brings intrinsic threats, such as the opportunity of borrowers skipping on their financings.

Entitlement Program Programs

Amidst the developing landscape of monetary services, a crucial element to consider is the world of Federal government Assistance Programs. These programs play a critical function in giving monetary help and assistance to individuals and services during times of need. From unemployment insurance to bank loan, federal government assistance programs intend to relieve economic burdens and advertise financial security.One famous instance of an entitlement program program is the Small Service Administration (SBA) fundings. These fundings provide favorable terms and low-interest prices to assist local business expand and navigate challenges - merchant cash advance loan same day funding. Additionally, programs like the Supplemental Nutrition Help Program (BREEZE) and Temporary Assistance for Needy Families (TANF) offer crucial assistance for individuals and families dealing with economic difficulty

Additionally, federal government aid programs extend beyond monetary aid, including real mca lenders estate aid, medical care aids, and instructional grants. These efforts aim to attend to systemic inequalities, advertise social welfare, and make sure that all residents have accessibility to standard needs and possibilities for development. By leveraging government support programs, individuals and companies can weather financial storms and strive towards an extra safe and secure economic future.

Final Thought

Report this wiki page